Saudi-Russia Oil Price Crash | Explained by Sohail Khan

Hello friends

Oil prices have crashed drastically worldwide A few months prior, the price of crude oil was 60 dollars per barrel Today, it has fallen and has touched almost 20 dollars per barrel A huge reason behind this is the ongoing price wars between three countries- the USA, Russia, and Saudi Arabia Such a huge crash not only has a great impact on the global economy but also has a vast effect on climate change and geopolitics Why exactly did this happen? What are these price wars ongoing amongst these countries? How will this oil price crash affect Pakistan? How will it affect the rest of the countries? Come let us see in today's article.

First of all, a small, basic economic concept that most of you would already know that the price of anything in a free market depends on demand and supply If the demand for something is more while the supply is less, then its price will rise The same is with oil. If the demand for oil is less and the supply is more, then its price will fall The top three oil-producing companies of the world in USA, Russia, and Saudi Arabia

|

| Saudi-Russia Oil Price Crash | Explained by Sohail Khan |

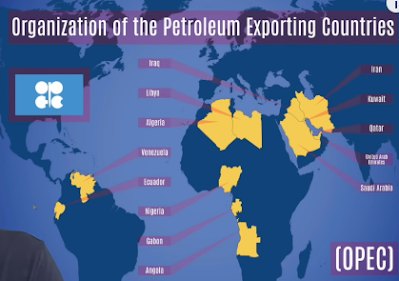

All the three countries all the oil-producing countries would want for themselves that they sell the most possible amount of oil at the highest possible price so that they incur the most amount of profit possible Generally, what would happen in a market is that the countries that buy oil would look for the cheapest option of buying oil and buy from there. And competition between the oil-producing countries would be maintained they would keep the price at the lowest amount possible so that oil is bought from them and they make profits nd this would drag down the profit of all the countries. An alternative is that they altogether decide to control supply and decide the price concertedly which would enable all of them to earn a respectable amount of profit. All would be benefited Therefore, an alliance exists between some of the oil-producing countries which is named OPEC

Organization for Petroleum Exporting Countries

|

| Saudi-Russia Oil Price Crash | Explained by Sohail Khan |

13 countries are a part of OPEC, including Iran, Iraq, Kuwait, Libya, Nigeria, UAE, Venezuela, and Saudi Arabia is also a part of OPEC But USA and Russia are not a part of OPEC OPEC is an agreement between these countries where they sit together and decide what the price of oil should be and how to control supply, which would prevent the fluctuations of price and ensure profits for everyone.

Although the enmity between Russia and the USA has been ongoing since the 1950s,

but in the aspect of the oil, it began around 2014

20- 30 years before today, the USA had been an oil-importing country

It did not produce so much oil on its own but imported it from other countries. Around 2010 -14 there was a revolution in its oil industries

due to which the USA became an oil-exporting country

The name of this revolution is the Shale energy revolution

They discovered a new technique of oil drilling

It was a combination of hydraulic fracturing and horizontal drilling which is called Shale oil due to which it extracts more oil from the existing oil fields in a more profitable way The shale oil turned out to be so revolutionary that it made the USA the world's number 1 oil producer

It left Russia and Saudi Arabia lagging behind

The USA snatched away the market share from Russia and Saudi Arabia

Due to the production of Shale oil, the supply of oil increased and the oil prices fell. This meant that the profit of the OPEC countries and Russia began to dwindle.

Initially, when the shale energy revolution commenced,

then the OPEC countries thought that they would have to destroy the USA's oil industry.

and keep their market share maintained

if they wanted to keep accruing profits in the future

To do this, the OPEC countries decided to increase their production due to which.

the oil prices worldwide would fall and due to this fall,

it would no longer be profitable for the USA to produce shale energy

And so they would stop production and so later they would become the sole oil producers later

Interestingly, the oil drilling in the USA is done by private companies

if the private companies of the USA would go bankrupt, then the USA government would not intervene to save them

But in countries like Saudi Arabia and Russia, the oil companies were nationalized.

So the government directly controlled them

So the government could keep funding the companies to keep them running.

SO everyone was facing losses but the OPEC countries were hoping that

the USA private companies would face losses and shut down

The competition would get ruled out. And they would compensate their losses from the governments.

and then they could maintain competition

But the plan wasn't so successful

Not all of the private oil producing companies of the USA shut down- only some of them did

But overall, they were able to keep themselves sustained when the oil prices were falling

But even today, Russia feels that it can root out the USA private companies from the competition

and can capture back its market share in oil production

And so Russia increased its supply and kept the prices low

if the prices remain low for a long time, the private companies of the USA would not be able to make profits

they would become bankrupt and would have to shut down ultimately

and Russia would be able to get back its market share

Russia is frustrated with the USA because of several other reasons

because there are the Crimea and Ukraine issues

The USA has imposed sanctions on Russia which is already having a lot of effects on their economy.

So they thought that they would bear the losses for the time being

During this time, they would indeed face losses but the USA companies would shut down.

And later when the USA companies would shut down, their market share would increase and.

then they would increase the oil prices and earn profit

Russia feels like it might be able to do what OPEC failed to

Alexander Dynkin- President of the Institute of World Economy and International Relations in Moscow.

It is Russia's think tank.

He said that Russia has decided to sacrifice OPEC+ top US Shale producers.

and punish the US for messing the Nord Stream 2 project

Nord Stream 2 was another project in which the USA imposed sanctions due to which Russia had to face losses.

Of course, to upset Saudi Arabia could be a risky thing

but this is Russia's strategy at the moment

flexible geometry of interests.

Russia knows that upsetting Saudi Arabia and OPEC is fighting a war on two fronts in a way.

On one hand, the US is being angered and so is the OPEC on the other hand.

But at this time, Russia has taken this decision because

It wants to target the US more and hence it decided to ignore OPEC's decision.

So what is the impact of this decision?

What Russia wants will happen to some extent

If low oil prices stay maintained over a sustained period,

there are a lot of small oil drilling companies in the US

Not all the companies in the US are huge, there are some small businesses indulged in oil drilling

They are going to face huge losses

They are going incurring huge losses because the demands have been low. So some companies might become bankrupt

But some big companies like Exxon and Chevron

They have enough money in their balance sheets that they wouldn't incur losses But small companies might get harmed

The US government is planning on giving government assistance to these oil drilling companies to prevent them from becoming bankrupt

Russia has enough money to bear these losses in the short term

but in the long term, the Russian economy would be adversely impacted because the Russian economy is dependent on oil-exporting in a major way In response, Saudi Arabia has also increased its production because why would it be left behind?

They too, want to maintain their market share.

They too can sustain losses for some time easily.

And they are gauging that if the US companies shut down, they'd be benefited.

and if Russia is unable to sustain, then too, it would be benefited

because everyone would come to them to buy oil.

The maximum brunt of this entire situation would have to be faced by small oil-producing countries.

For example, Iran, Iraq, Brazil, Argentina.

Ivory Coast, Malaysia, Indonesia, Azerbaijan, Kazakhstan.

Because of the oil prices remain so low, they would not be able to sell oil at a profit

They would not be able to earn money.

And since they are small countries, their entire economy is dependent on oil.

Nor do they have enough money to sustain themselves in the long term on such a small profit margin

The maximum benefit in this situation would be availed by the oil-importing countries.

0 Comments

Hello Bro